You already know that Gen Z is drinking less alcohol than previous generations. But what are the key factors driving this trend? How long is it expected to last? Which non-alcoholic drink categories are leading in sales? And what are some innovative ways that businesses and brands can leverage buzz-free drinks to cater to Gen Z’s sobering demands?

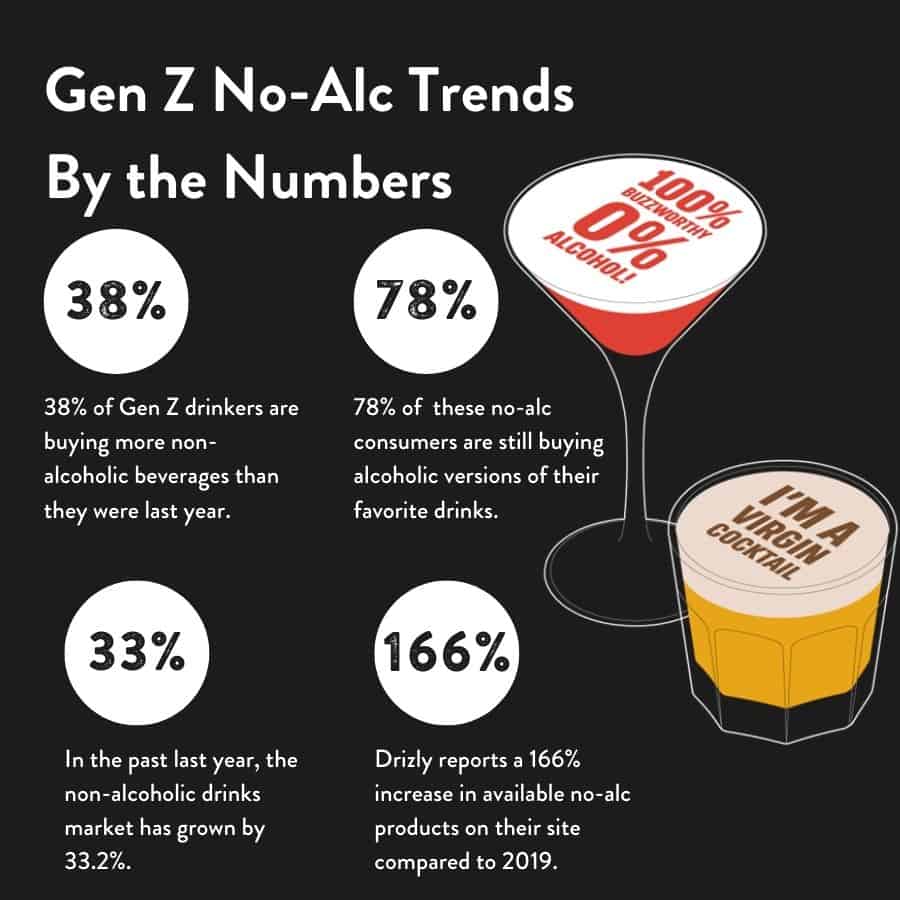

38% of Gen Z drinkers are buying more non-alcoholic beverages than in the previous year. The trend in non-alcoholic drinks started growing noticeably on a global scale in 2014, but as more Zoomers come of age, their tastes and preferences are dramatically spiking sales. A recent 2022 consumer report, issued by the leading alcohol ecommerce platform Drizly, highlights that 38% of Generation Z buyers are drinking more non-alcoholic beverages than in the previous year. Compare that to just 8% of Boomers, 15% of Gen X, and 25% of Gen Y.

Takeaway: Gen Z is more open and excited than previous generations to try new and innovative beverages — especially those that align to their values (more on that below).

166% increase in the number of non-alcoholic products compared to 2019. Rising demand and lower barriers to market entry have also resulted in a huge increase in the variety of non-alcoholic products across all drink categories. Drizly reports a 166% increase in the total number of non-alcoholic products on its site compared to 2019. It’s unclear what came first, the chicken or the non-alcoholic strawberry-lime canned margarita, but what is clear is that Gen Z drinking habits are fueling the no-alcohol trend in a continuous loop of innovation and demand.

Takeaway: With so many new products on the market, it’s easier than ever to grab and hold Gen Z’s interest using a fresh mix of non-alcoholic drink choices.

As a market, no-alcohol is growing 4X faster than low-alcohol. Though the low-alcohol drinks market is significantly larger ($2.77 billion versus $331 million), recent Nielsen reports show that the market for non-alcoholic beverages has grown faster over the last year (+33.2%) compared to that of low-alcoholic beverages (+8.1%). With Gen Z spearheading the non-alcoholic drink trend, these numbers make sense. As a generation of digital natives, one of the core reasons for Gen Z’s declining alcohol consumption is risk aversion and a fear of having drunk behavior publicly broadcast on social media.

Takeaway: The no-alcohol drinks market is growing faster among Gen Z because it meets their unique need for safe, social drink experiences while still providing a ‘special occasion’ treat.

58% of Zoomers value authenticity as ‘very important’ among brands Though big-name brands are constantly releasing large-scale non-alcoholic offerings, the real innovation in the NA drink space can be found among independent beverage brands producing small-batch, craft, and flavored options. This appeals to a majority of Gen Zs who favor values-driven consumption, with a special affinity for transparency and authenticity — something that smaller brands often have working in their favor.

In this aspect, Gen Z is even more devoted to their causes than Millennials. A recent McKinsey study on the importance of purpose in consumer purchase decisions reports that 58% of Zoomers value authenticity as ‘very important’ in their purchase decisions. So it’s little wonder that some of the most popular up-and-coming non-alcoholic beverage brands run under taglines such as: “Created by plant scientists and bartenders” (Three Spirit); “What began in a kitchen in the woods is now leading a worldwide revolution–changing the way we drink” (Seedlip Herbal Elixirs); and “Shaken, not slurred” (Curious Elixirs ready-to-drink mocktails). See here for other notable spirits marketing trends in 2022.

Also of note:

- Sales for non-alcoholic spirits have increased 113.4% since 2020, surpassing growth of both non-alcoholic beer (31.7%) and wine (39.4%), according to Nielsen.

- Sales for RTDs have risen a meteoric 400% since 2019 on Drizly.

Takeaway: Don’t be afraid to introduce non-alcoholic drinks by independent brands — especially spirits and RTDs. Gen Z places a high value on getting exposure to these new and unique offerings.

Health and environmental concerns drive 42% of Gen Z purchase decisions. Second to authenticity, health and environmental concerns are also key values that drive Generation Z’s purchase decisions. McKinsey reports that 42% of Zoomers and 53% of Millennials cite ‘recyclable products, packaging and related initiatives’, plus ‘No artificial ingredients, non-GMO/natural’ as ‘very important’ in their purchase decisions. Non-alcoholic drink-makers are responding with innovative beverage formulations made from a growing list of plant-based, functional ingredients and manufactured using sustainable packaging.

Takeaway: Both Gen Z and Gen Y are willing to pay a premium for healthier, more sustainable drinking experiences.

And don’t forget – it’s almost never either/or. Moderation is the name of the new Gen Z Drinking Game Across the board for all generations ,buyers of no- and low-alcohol beverages aren’t fully giving up on alcohol. 78% of non-alcoholic beer, wine, and spirits consumers are still buying alcoholic versions of their favorite drinks. When opting for a buzz-free night out, they often cite healthier lifestyles and declining interest in alcohol as top reasons.

So now what? Best Practices for Bars and Businesses Serving Gen- Z Drinkers

- Include interesting mocktails alongside your standard cocktail menu. With so many new options cropping up, it’s easy to find ones for every taste and price point.

- Highlight regional/locally sourced ingredients where possible. You’ll earn extra loyalty points among Gen Z customers for offering sustainable, values-driven menu items.

- Focus on creating an experience your customers can’t have at home. Like eye-catching, personalized beverage-top prints made from all natural ingredients using a Ripple Maker!

- Start your relationship early with beverage advertisements and a social media presence. Always online, this generation of digital natives is likely looking for their next great drink experience on their phone – so make sure they can find you.

References:

- 2022 Drizly Consumer Trend Report

- The No-Alcohol Industry Boomed Over the Padnemic. Where’s it Going Next?

- The sober curious movement is impacting what Americans are drinking

- New Insights into the Gen Z Drinker

- 7 Non-Alcoholic Elixirs for Sober Curious Sipping

- Meet Generation Z: Shaping the future of shopping